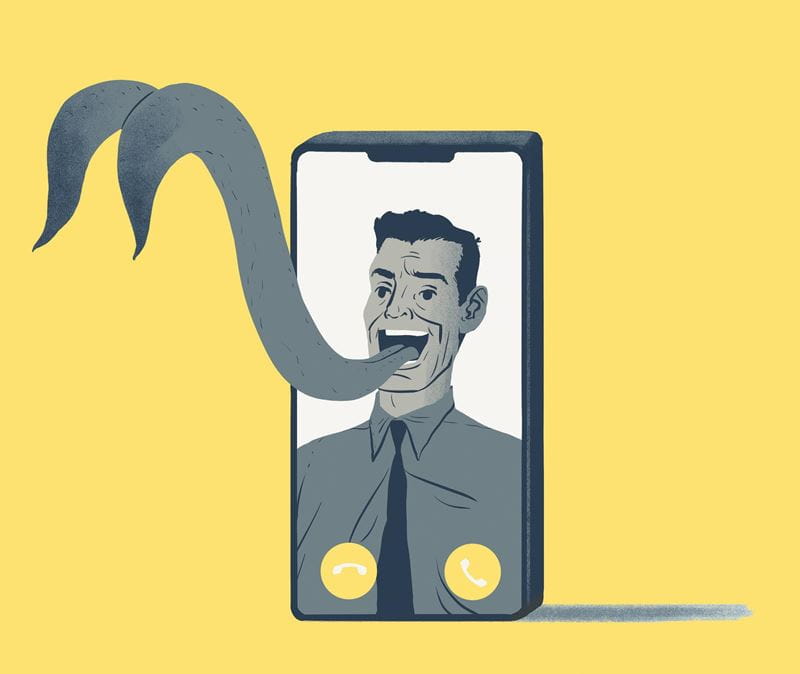

How to spot a scam - and protect yourself

We've got the expert advice on the most common frauds in 2024 – and how to avoid falling victim to them

We've got the expert advice on the most common frauds in 2024 – and how to avoid falling victim to them

Nick Stapleton, is co-presenter of the BBC’s Scam Interceptors. He's got the three biggest scams currently affecting people and how to avoid them.

The frightening truth is that being scammed has now become one of our most universal experiences, with incidents on the rise and a recent report from the Social Market Foundation showing that one in five people globally have been victims of fraud, with 36% of them over 55.

In the UK last year, scams represented more than 40% of all crime – the most common type – with 3.5 million adults losing money to scams and fraud and their average losses coming out at over £4,000. That puts the money leaving our economy to criminals in the region of £17 billion.

But, shockingly, in the UK, we only convict one in every 1,000 fraud cases. It’s an appalling situation but being au fait with the scams of the day will help protect you and your family from becoming a victim – and believe me, no one’s too clever to get caught out.

Our experts at Saga Money also have more detailed advice on other common scams to help keep you safe:

At Scam Interceptors, this is probably the most common scam we deal with and it disproportionately affects older members of the population because scammers usually target those with landlines who are at home during the day, although they sometimes call mobile phones too.

When you answer the phone, a robotic voice says something like: ‘There have been transactions on your card totalling £x and £y, if this was not you press 1 to speak to the fraud department.’

Should you press 1, someone claiming to be your bank’s fraud department will ask you to confirm your name and date of birth and try to draw further information from you, such as your account number and sort code in the guise of ‘security questions’.

If you reveal them, they’ll either provide a number to call claiming it’s the number for the ‘fraud department investigator’, or you’ll shortly receive a call back from a ‘manager’.

In this second call, the scammers begin to use all the information obtained in the first against you, spinning a yarn about fraud involving employees at the local branch of your bank. Sometimes fraudsters will go so far as to pose as policemen.

How do they know which branch you use? They’ve used a sort code checker tool to find out where you opened the account. The scammers then set out to persuade you that to help their investigation into these imaginary fraud-committing employees, you must withdraw cash from your local branch. They may even send a taxi for you.

They will usually ask you to withdraw around £2,000 to £5,000, certainly less than £10,000 to avoid arousing too much suspicion. Bank impersonation scammers might even run you through what to say at the bank – telling you to claim you’re doing work on your home and need to pay a builder in cash, or similar.

All of this is lining up a third call, when you arrive home with the cash, where you’ll be asked to post your money to the ‘investigating officer’. Should you comply, you’ll never see that money again.

Here’s the most important thing to remember: if you ever receive a call like this, hang up (see warning, below) and call your bank on the number on your statement or your bank card.

If the caller says they are a police officer, ask for their collar number, hang up (see warning, below) and then call your local police station or 101 and check the collar number.

That is the only way to be sure you’re really speaking to your bank or a PC. Calls like this are 99% likely to be a scam and should be viewed as one until proven otherwise.

Scammers can stay on the line after you’ve hung up. If you can, use a different phone.

If using the same phone, wait 10-15 minutes before making a new call or phone someone you know to ensure the line is free.

This scam has been doing the rounds in a big way, accounting for 49% of all recorded scams in the UK last year.

You’ll get a text message or email that seems to come from either Royal Mail or one of the private delivery companies such as Evri or DPS.

The message usually explains that there is a small fee (£2-£4) to cover the cost of redelivery of a package, providing a website address to click on so that you can enter card details and cover the cost.

You can tell that the messages aren’t legitimate if you look very closely, as the website address will be nothing to do with the real website of the company it claims to be from. If you’re a computer user, you can check the real one using a search engine and just searching the company name. Does the website match the one in the website address you’ve been sent? You might often find the sender doesn’t quite look as it should either.

If you provide your details, the scammers aren’t only going to steal a few quid from you – they will use this information to come back for more.

Some weeks later you will probably receive a call out of the blue from a person claiming to be your bank, who seemingly has very good information regarding your name, address, even your card number. Very convincing – but of course that’s the information you gave to pay for your ‘missed delivery’.

This caller will then try to run a bank impersonation scam on you not unlike the one detailed above. Again, the most important thing to remember with these out-of-the-blue calls is simply to hang up (see warning, above) and phone back on a number you have for your bank yourself. They’ll no doubt try to put you under pressure, but take a breath and stick to the plan – nothing is as urgent as scammers like to try and make it sound.

If you’ve been a victim of fraud and would like information or help, call Victim Support on 08 08 16 89 111.

Also see Stop Think Fraud for more information.

Pensions have always been rich territory for scammers but the cost-of-living crisis has exacerbated the problem.

It is very important to spell out immediately that all cold calls relating to pension advice have been banned in the UK since 2019. Furthermore, changes in law later this year will outright ban any cold call related to financial products.

If you are receiving calls of that nature, you can be 100% assured that you’re talking to a criminal. Don’t feel like you need to be polite, just hang up. Many pension scammers will claim that they aren’t cold calling with anything to sell, merely offering free advice, which is not illegal.

But there’s no such thing as a free lunch. If a caller claiming to offer it for free starts using phrases like ‘limited-time offer’, ‘guaranteed returns’ and ‘early access’, those should represent enormous red flags that a pension scam is coming your way.

These ‘free advice’ callers will inevitably try to persuade you to call someone else to hear what they have to say, which is where the scam will start. Do not agree to transfer your pension if you’re doing so on the advice of a caller like this, a number you have been given by them or an advert you’ve seen online – take professional advice from an FCA-registered firm.

If you’ve already agreed to something which sounds like this, contact your old pension provider immediately, and if you want to report a pension scam, you can do so to the Financial Conduct Authority via its consumer helpline on 0800 111 6768.

1. Assume any call or message coming out of the blue is a scam until proven otherwise.

2. If you receive a suspicious call, do not give out any personal or bank details. Hang up (see warning, above) and call the company they claim to be from.

3. Don’t click on any links if you receive a text or email that doesn’t look right.

4. If you do believe you have lost money to a scam, your bank’s fraud department should be your first call. Also report any scams to Action Fraud on 0300 123 2040; actionfraud.police.uk. Forward suspicious texts free of charge to 7726.

Ingenious speakers, brilliant earbuds, nifty note takers - our expert picks his top tech gifts.

Electric models are set to dominate the market next year, including a flood of budget Chinese brands.

How breaking my phone ruined one of the best nights of my life - and the expert lessons that will help you avoid my mistakes

New to podcasts? Here’s our straightforward guide to finding them, playing them and enjoying them.

The EVs you should consider before the new electric vehicle road tax comes into force.

As the use of contactless soars, our columnist asks what can be done to prevent discrimination against those still wanting to use cash.

Follow our step-by-step guide to find out your internet speed - and whether it’s your device or broadband that’s slowing you down.

These video doorbells show you who's at your door, even when you aren't home.

We explain everything you need to know to connect an iPhone to an Apple Watch.

Think you know how to use WhatsApp? We've got some handy tips to help you get the most out of the messaging app.